Quicko is a free website which lets you prepare and file your income tax return, GST return, and TDS return online for free. The website provides you a simple interface where you can add your income, deductions, etc. and see what kind of refund you are getting or maybe you owe taxes to the government.

The website offers you free income tax returns, free GST returns, and free TDS returns. All you have to do is register an account with the website and start entering data.

Let’s look at how this website works.

First of all open this website up using the link given at the end of this article. The website home page looks like the screenshot above. Click the sign up button to register an account with the website. For signing up you will need to enter an email address. After that some more details need to be entered like your name and a password for your account. You will receive a confirmation email to verify your email address and account. Once that is done, you can now login to the website using the credentials you set.

After logging in, you will see a welcome screen, like the one seen in the above screenshot. Here you can fill in income tax return, GST return, or TDS return for individuals or businesses. Click the one which you need.

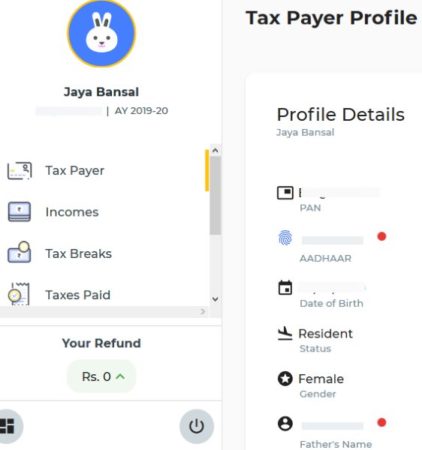

For an example, I’ll start with the income tax return for an individual. When you click on income tax tab, you will be shown on the next screen that you will be required to create a profile for yourself by entering some information like name, PAN number, gender, date of birth, residential status, etc. Click on start to get started with filling this information.

Once done, you will be shown a profile page like the one shown above. Here you can fill out some missing information like address and contact number. Then on the left side you will notice six tabs namely tax payer, incomes, tax breaks, tax paid, bank account, and ITR. Click on the incomes tab to enter your income for the year.

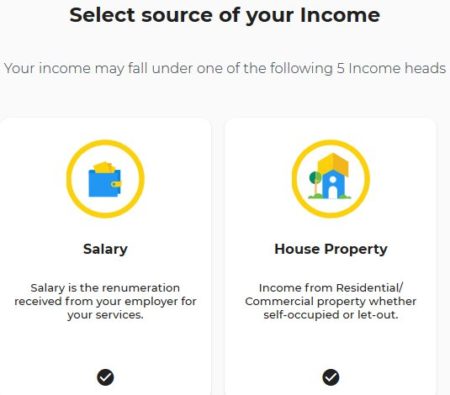

The income category is divided in to 5 heads which are salary, house property, other, business & profession, and capital gains. Enter the details of which ever category you have earned income in.

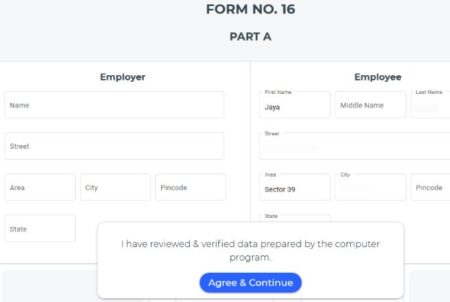

If you are a salaried employee you can upload your form 16 to the website and it will read the form automatically. If you do not have a form 16, then you can enter the details manually. Once done, click on agree & continue button given at the bottom. Once you are done with the income section, you can move on to the tax breaks or deductions section.

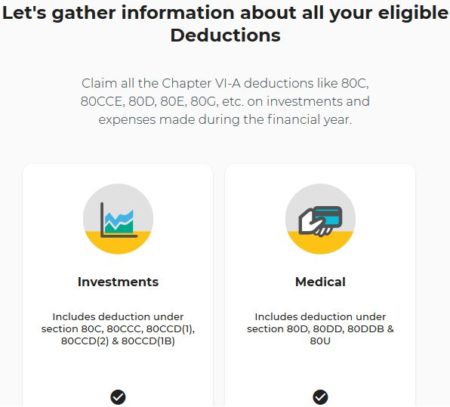

In this section, check out the available deductions and what all is applicable to you like tax investments, medical deductions, donations made, etc. After you have filled up details in this section you will move on to tax paid section.

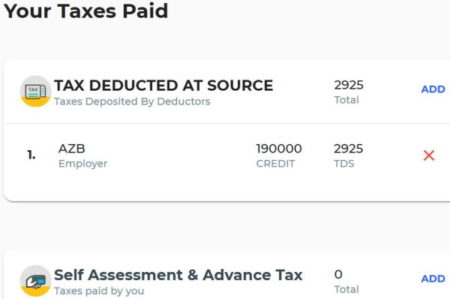

This section contains tax that you have already paid through TDS. Apart from that you can also add self assessment tax and advance tax paid by you.

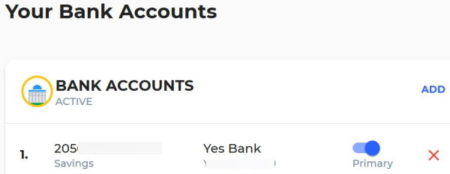

After this section you come to the bank account section, where you can add your bank account information like account number, IFSC code, name of the bank, type of account, etc. Once you have added this information, you can use this account to receive the tax refund in this very account.

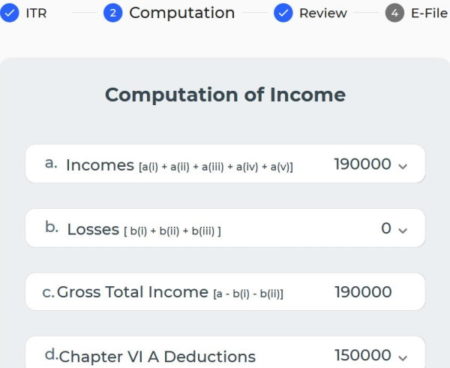

Now move on to the ITR tab, and review the information that you have added so far. Click on the computation tab from the top, or you can even click the continue button at the bottom of the page. On the computation page, you will be shown the computations and the amount of refund that you will be getting.

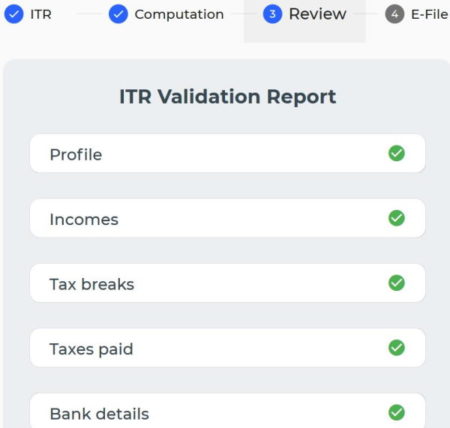

Click the continue button and you will move on to the validation screen. Where you are shown a validation screen, to check if the information your entered looks good. If you have all green check marks than you are good to go. In case, you have red check marks then you need to revisit that section to correct the errors.

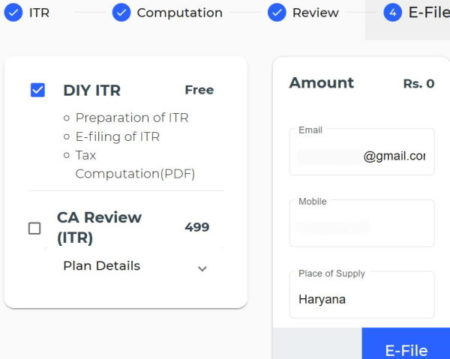

Click continue and you will be ready to file your return now. On this page, as can be seen in the screenshot above, you will be shown that the total amount for your income tax preparation is zero. That means, free. In case you need a CA to review your income tax return, then you will be charged a small fee for that.

But if you are satisfied with the income tax returned that you have filled, then you can go ahead and efile it. All you have to do is press the efile button and your return will be submitted. Once your return is processed you will receive a acknowledgement on your email.

Overview:

Quicko is a nice website where you can file your taxes on your own. If your income tax return is not complicated, then it is something you can do yourself, instead of spending money on tax preparation. The website is pretty straightforward, just enter the information you are asked for and keep moving forward. You can file your income tax return, TDS return, and GST return using this website. So give it a try.

Check out Quicko for tax filling here.